- HOME

- ALL ARTICLES

- Certified Payroll Forms

Certified Payroll Forms & Information

By Diane Dennis

"Certified Payroll Forms" and "Prevailing Wage Payroll Reports" and "Government Payroll Forms" Explained

Oh boy, certified payroll forms used to intimidate me like no other.

I was so sure that one mistake was going to have the government knocking on our door.

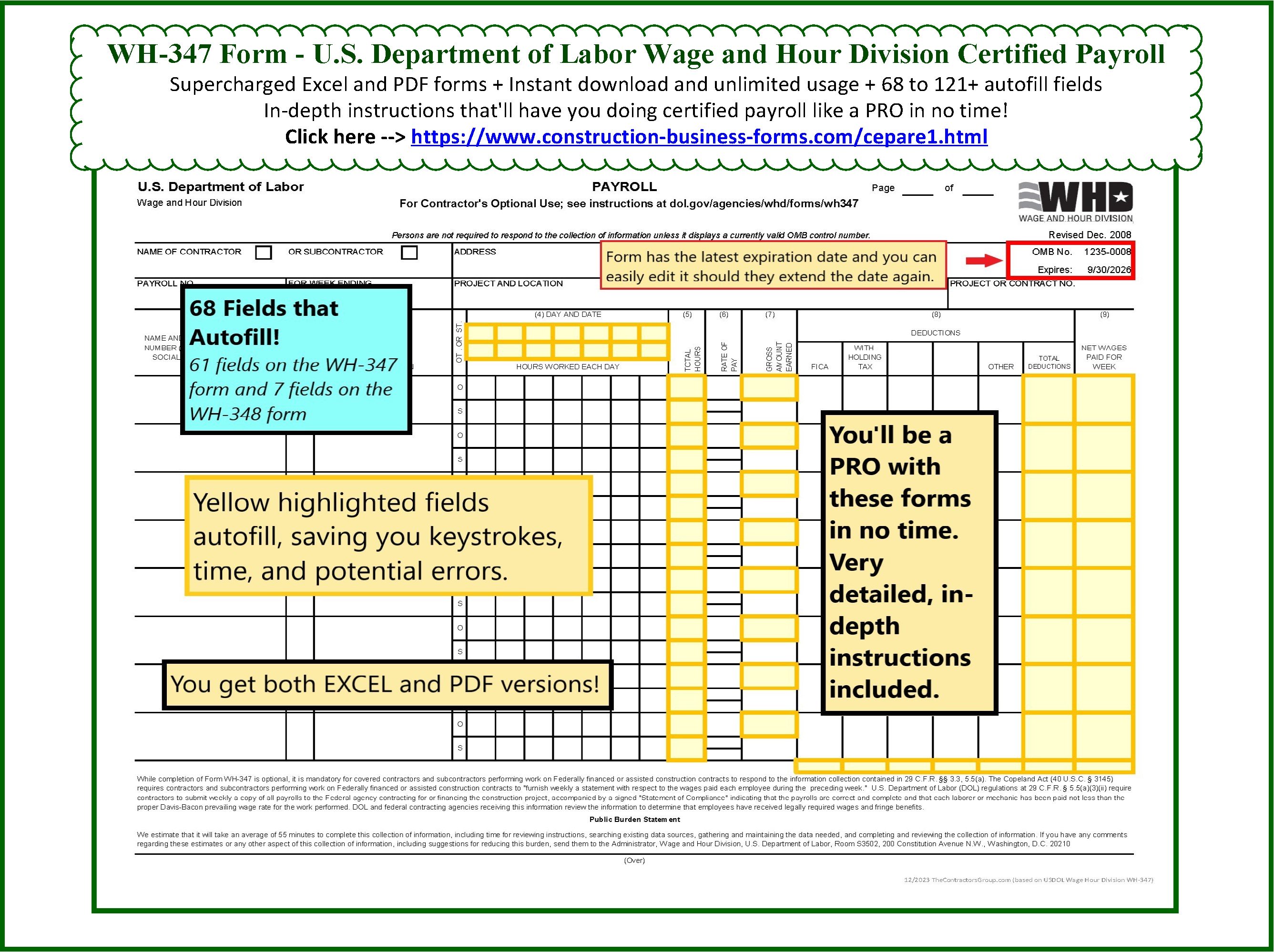

WH-347 Form & WH-348 Form - Excel and PDF

- Instant Download

- Unlimited Usage

- Unlimited Free Replacement

- Unlimited Free Support

- Fill-able, Save-able, Calculates

Comes With Exclusive, In-Depth Instructions

Construction-Business-Forms.com

Once I better understood it all I became more comfortable. I can now say don't let certified payroll forms and prevailing wage, or its related forms and documents, intimidate you.

It's so easy once you understand and I'm here to help with that understanding. Soon you'll find yourself helping someone else to understand the process - maybe even your own customer(s).

What information do the certified payroll forms require?

Most public entities, federal and state, require contractors on the project to submit certified payroll forms that are a written record of:

Certified payroll forms are typically used on projects that are known as public works projects. A public works project is a project that is at least partially funded by government/public entity funds.

- The name and social security number (or other identifying number) of every employee the contractor has working on the project

- The classification of each employee

- The withholding information for each employee

- The straight time and overtime hours that the employee works on the project

- The

gross amount the employee has earned for the pay period for all jobs the

employee worked on, whether for this particular project or another

- The individual deductions from the employee's paycheck

- The total amount of deductions from the employee's paycheck

- The net amount of the employee's paycheck

- The number of the check that the employee is paid with

Why are the certified payroll forms needed?

The forms are designed to help contractors to submit information regarding their payroll when performing work on a certified payroll project which are typically financed at least in part by government/public entity funds.

These forms also allow the public entities to track who is working on the project, and that each worker is being paid correctly, and that deductions are being handled properly.

While most contractors will be honest and pay what they're supposed to pay to the employee, unfortunately there are some contractors out there who don't and then they lie on these forms.

We know of more than one occasion where the contractor paid the employee the prevailing wage rate, then when the employee cashed his check, he was required to give back to his employer the difference between his regular wage and the prevailing wage rate.

Doing that allows the contractor to either make a killing on the project, or underbid you and win the job.

Unfortunately those bad eggs are out there and those business practices of theirs will win the bid pretty much every time (underpaid wages = lower bid).

Thankfully the reporting requirements make it so that the government has plenty of information to hopefully track down those bad eggs once they start reporting payroll on the project.

Where to get these required certified payroll forms?

WH-347 Form & WH-348 Form - Excel and PDF

- Instant Download

- Unlimited Usage

- Unlimited Free Replacement

- Unlimited Free Support

- Fill-able, Save-able, Calculates

Comes With Exclusive, In-Depth Instructions

Construction-Business-Forms.com

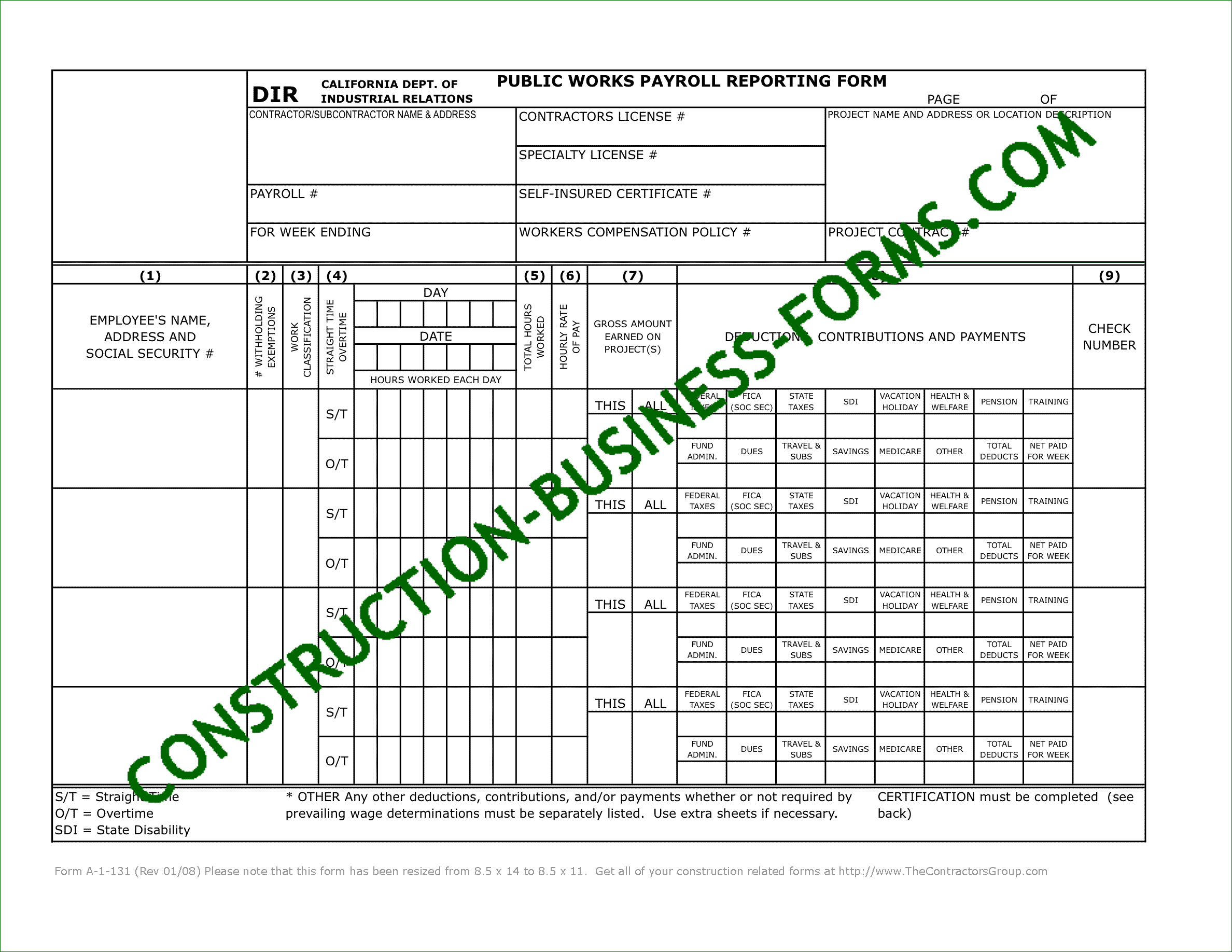

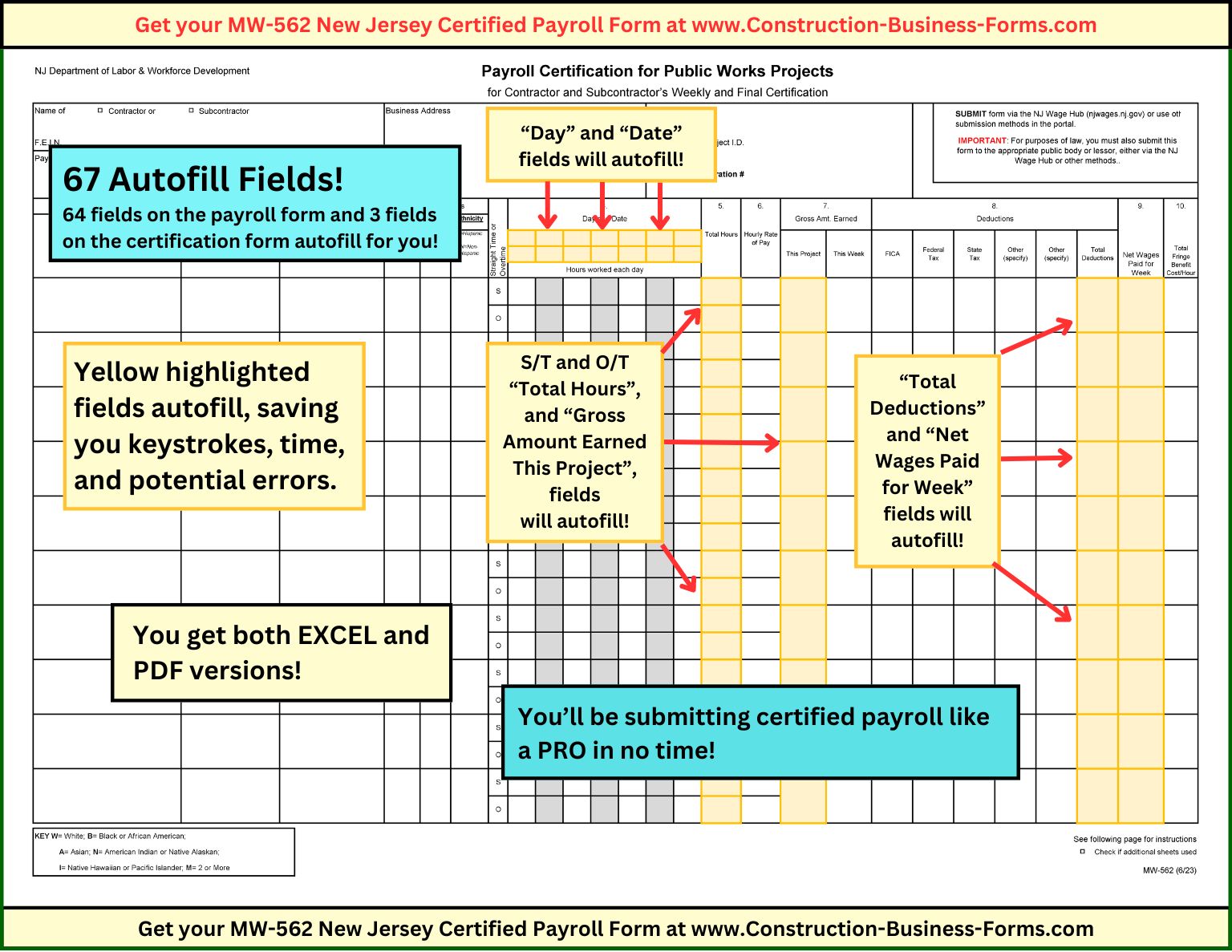

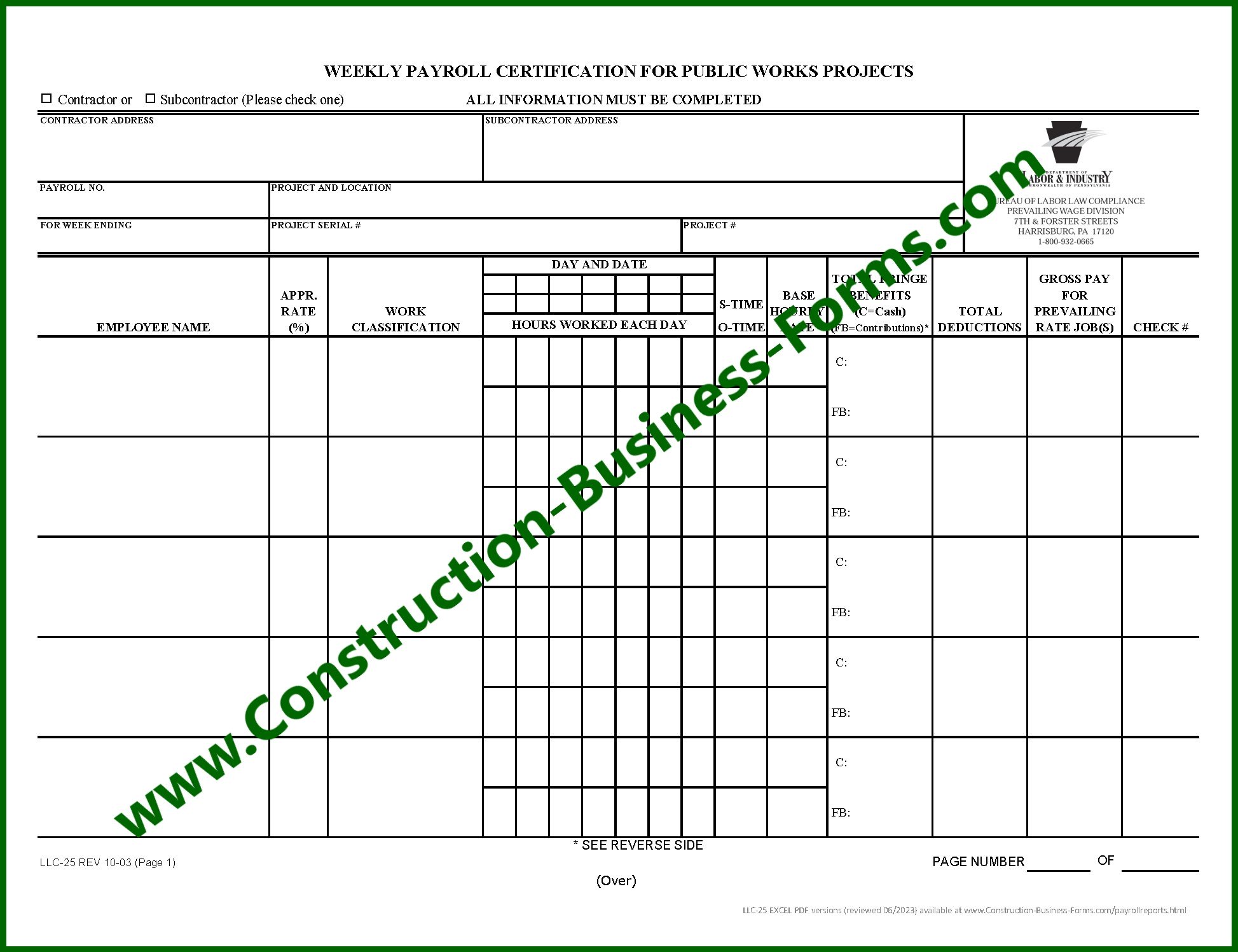

Some states have their own forms and some use the WH-347 federal certified payroll form.

There are several states forms available here, as well as the Federal Department of Labor form.

You can fill them in with your computer and they'll do some basic calculations for you (but they don't have tax tables or prevailing wage rates built in).

The entire form, including your filled in information, will print on a plain 8 1/2 x 11 sheet of paper.

Here's a short list of some of the certified payroll forms that we have available:

Filled-in samples and detailed how-to instructions are included. :o)

Article Series: Prevailing Wage & Certified Payroll

Certified Payroll WH-347 Form and WH-348 Form and Information

- Certified Payroll Forms and Information

F700-065-000 Washington State Certified Payroll Report

- Information and a Link to the Form

How to fill in the WH-347 Form and the WH-348 Form

- In-Depth, Step-by-Step Guide and Information

Certified Payroll Wage Warning re: Prevailing Wage Determinations Online for the DOL

- The Prevailing Wage Determinations Online website is filled with pitfalls that could negatively affect your contract profitability. If your General/Direct Contractor (your customer) tells you to determine the wages, read this...

Prevailing Wage Compliance Made Simple

- The terms "prevailing wage" and "certified payroll" can send even the toughest contractors heading for the hills ... but not any longer.

Military Base Requirements

- Most often, when working on a military base, you will be required to show...

New Jersey Payroll Certification & Fringe Benefits

- Information and exclusive Excel version of the form

Bookmark me!

Bookmark my site and let me help you with your construction project management - together we'll crush the chaos of contracting!

Be sure to subscribe to my free newsletter to stay updated on happenings here at the site, updates to the downloadable construction forms, and ongoing news in the construction world.

Thank you for visiting and have a great day!

Diane

New! Comments

Please leave me your comments below. Facebook doesn't notify me of comments but I'm tickled when I come across them and I always respond when I see them.