- HOME

- ALL ARTICLES

- WH-347 Certified Payroll Forms How-to

The WH-347 Certified Payroll Forms

Please scroll down to read the how-to for the WH-348 Statement of Compliance forms...

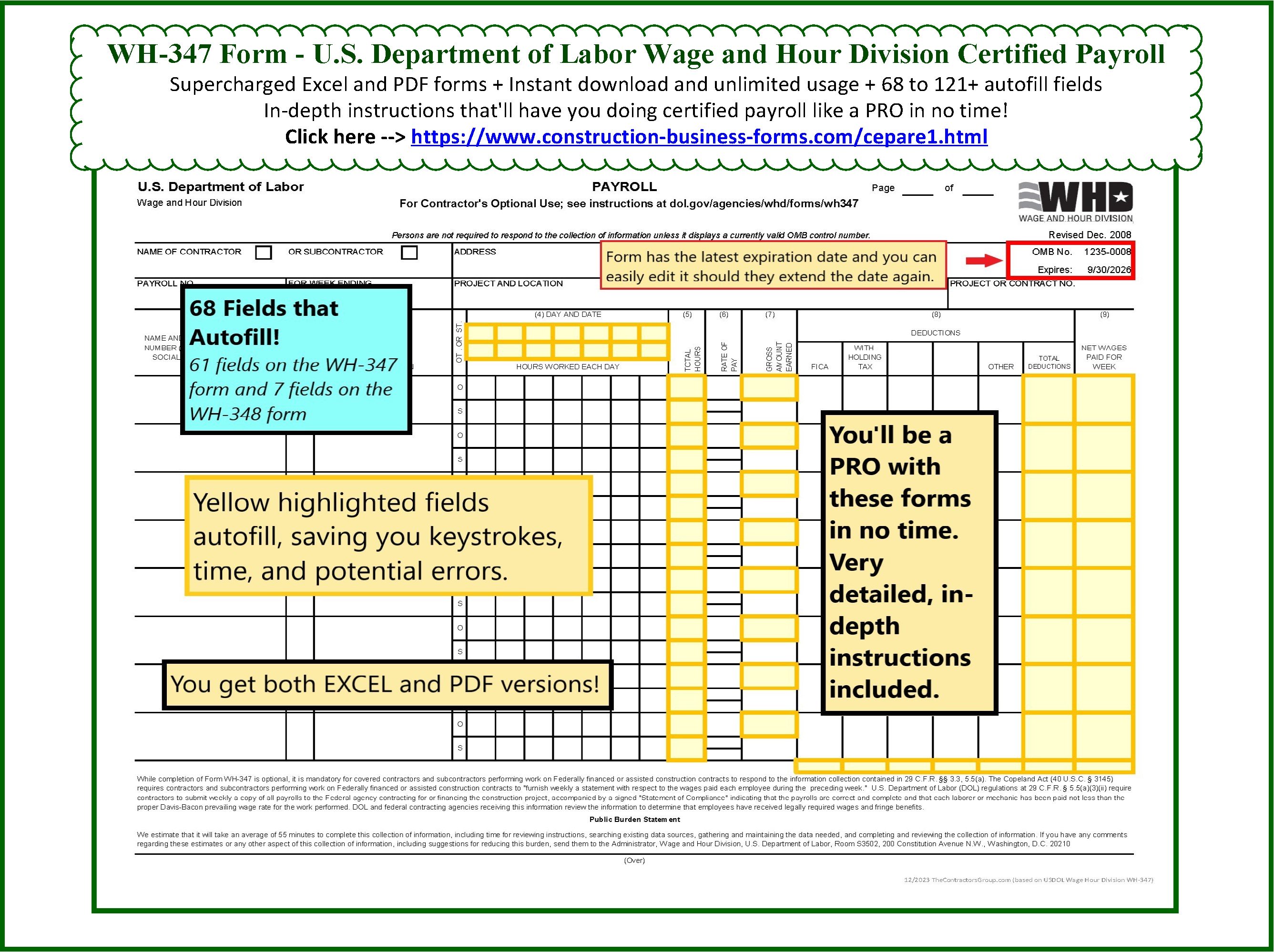

Click to get your updated

WH-347 Davis-Bacon Federal Certified Payroll Reports!

The government recently extended the expiration date for the OMB number, from 07/31/2024 to 09/30/2026. They also revised the layout of the WH-347 form.

Get your new forms today!

How to Fill in the WH-347 Certified Payroll Forms

The USDOL Wage & Hour Division created the WH-347 certified payroll forms as a guide for contractors to help them to submit information regarding payroll when performing work on a federally-funded project covered by the Davis-Bacon Act.

It's not required by law that contractors use the form to report their payroll, it's just required that the information be submitted in some understandable format.

Nevertheless, it seems that most general/direct contractors require those performing work on the job to use these forms specifically.

This page contains detailed, step-by-step instructions on how to fill in the WH-347/348 forms. It's a dry topic for sure but this page will make you a PRO at it. No longer will it be a struggle to get through your certified payroll

Here we go!

Page ___ of ___

When filling in the WH-347 form, there are eight rows available for employee names and information. If you have need for more than eight rows, you'll have to use additional forms. The Page ___ of ___ section will allow you and your customers to easily keep the multiple payroll forms for that pay period in order as well as it'll be obvious if any of the forms for that pay period are missing.

If you'll be using eight or less rows, enter 1 of 1.

Name of Contractor or Subcontractor

Check the appropriate box for which contractor you are (General/Direct or Sub).

Below that, type in the name of the contractor employer that is

submitting this document, not the name of the company that it's being

submitted to.

Address

This is the address of the contractor/employer submitting the WH-347 form.

Payroll Number

The instructions from the USDOL Wage & Hour Division state to start the first week on the project with "1".

For Week Ending

This will be the last date of the pay period for the week you're submitting the form for.

Project and Location

You'll enter the project name and location in this field - typically that information will be provided by your customer.

Project or Contract Number

These projects always have a project or contract number. This is the

field where that information belongs - and just like the project name

and location, your customer will provide you with this number.

Day and Date

The first box in the first row here will be the first DAY of your payroll workweek and the last box in this row will be the last DAY of your payroll workweek.

The first box in the second row will be the first DATE of your payroll week and the last box in this row will be the last DATE of your payroll workweek.

These boxes will autofill for you when using our Excel and PDF WH-347 certified payroll forms available here!

Additional Deductions

In the Deductions column (8), there are two columns with blank headers for additional deductions. This is where you'll enter any additional deductions from your employee(s) paycheck (if applicable) over and above FICA and Withholding Tax.

If you do have additional deductions to report, enter the title of the third deduction (and fourth if applicable) in the blank box(es) at the top of the column and the amount(s) deducted from each employee's paycheck in the appropriate box(es).

If five or more deductions are involved, you'll use the first four columns as explained above and then show the balance of deductions in the "Other" column - and - in the attachment to the payroll describe the deduction(s) contained in the "Other" column.

Please note that all deductions must be in accordance with the provisions of the Copeland Act Regulations, 29 C.F.R., Part 3. If the employee worked on other jobs in addition to this project, you'll show the actual deductions from his/her weekly gross wage, and indicate that those deductions are based on his gross wages.

Employee Name and Individual Identifying Number

On many certified payroll forms out there the social security number of each employee is required. Fortunately that is NOT required on the WH-347 form.

Instead of providing social security numbers you can provide an "individual identifying number". This can be each employee's individual payroll number, or the last four digits of the employee's SS#, etc.

Number of Withholding Exemptions

Providing this information is NOT a requirement of U.S. Department of Labor (DOL) Regulations, Part 3 and 5. This column was provided on the WH-347 certified payroll form simply for the employer's convenience and is not required to be reported.

Worker/Employee Classification

This is where you'll enter your employee's work classification on the project. If the employee works under two or more classifications on a project, enter him on a separate row for each classification that he worked under.

Daily Hours Worked

This is where you'll enter your employee(s) daily hours worked. The straight time

hours are entered into the bottom row and the overtime hours are entered into the top row.

Total Overtime Hours Worked

Total up the overtime hours worked, if any, and enter it in the top box.

These boxes will autofill for you when using our Excel and PDF WH-347 certified payroll forms available here!

Overtime Hourly Wage Rate

If the employee worked overtime, you'll enter his/her overtime hourly wage rate here. When overtime is worked, show the overtime hourly rate paid plus any cash in lieu of fringe benefits paid in the "overtime" box for each worker; otherwise, you may skip this box.

Payment of not less than time and one-half the basic or regular rate paid is required for overtime under the Contract Work Hours Standard Act of 1962 if the prime contract exceeds $100,000.

Total Straight-time Hours Worked

Total up the straight-time hours worked and enter it in the bottom box.

These boxes will autofill for you when using our Excel and PDF WH-347 certified payroll forms available here!

Employee's Straight-time Hourly Wage Rate

This is where you'll enter the employee(s) straight-time wage rate.

When reporting the straight-time wage rate, any cash paid in lieu of fringe benefits may be shown separately from the basic rate. For example, "$12.25/.40" would reflect a $12.25 base hourly rate plus $0.40 for fringe benefits.

There is a box provided directly under the "Straight-time Hourly Wage Rate" for you to enter the Fringe Benefit Hourly Rate if applicable.

When using our Excel and PDF WH-347 certified payroll forms available here, the gross and net amounts paid will calculate and autofill for you, including the fringe benefit rate if applicable.

Employee's Fringe Benefit Rate

There is a box provided directly under the "Straight-time Hourly Wage Rate" for you to enter the Fringe Benefit Hourly Rate if applicable.

When reporting the straight-time wage rate, any cash paid in lieu of fringe benefits may be shown separately from the basic rate. For example, "$12.25/.40" would reflect a $12.25 base hourly rate plus $0.40 for fringe benefits. This is of assistance in correctly computing overtime.

When overtime is worked, show the overtime hourly rate paid plus any cash in lieu of fringe benefits paid in the "overtime" box for each worker; otherwise, you may skip this box.

In addition to paying no less than the predetermined rate for the classification which an individual works, the contractor must pay amounts predetermined as fringe benefits in the wage decision made part of the contract to approved fringe benefit plans, funds or programs or shall pay as cash in lieu of fringe benefits.

Gross Amount Earned This Week on THIS Project

This is where you'll enter the gross wages earned by this employee this week on THIS project specifically (as opposed to including any hours he might have worked on other projects this week).

The totals will auto-calculate and autofill for you when using our Excel and PDF WH-347 certified payroll forms available here! The in-depth instructions included explain what to do when your employee does work on multiple projects in one week.

Gross Amount Earned This Week on ALL Projects

This field is for wages earned on "ALL jobs this week".

If the employee worked on other jobs this week in addition to this one then enter the total gross amount from his paycheck for this week in this field.

The bottom box must be filled in as per the USDOL requirements if the employee worked on additional projects this pay period.

Deductions

This section is strictly for deductions; nothing that is added to the employee's check (e.g. sick pay) gets entered into this section. Additions are covered in the "Employee's Fringe Benefit Rate" section.

FICA and Withholding Tax: Enter the FICA and Withholding Tax amounts withheld from the employee's paycheck.

Additional Deductions: As explained in "Additional Deductions" above, there are two columns for additional deductions. This is where you'll enter any additional deductions from your employee(s) paycheck (if applicable) over and above FICA and Withholding Tax.

If you do have additional deductions to report, enter the title of the third deduction (and fourth if applicable) in the blank box(es) at the top of the column and the amount(s) deducted from each employee's paycheck in the appropriate box(es).

Other Deductions: If five or more deductions are involved, you'll use the first four columns as explained above and then show the balance of deductions in the "Other" column - and - in the attachment to the payroll you'll describe the deduction(s) contained in the "Other" column.

Total Deductions: This is where you'll enter the total amount that was deducted from the employee's paycheck for this pay period. The total deductions will auto-calculate and autofill for you when using our Excel and PDF WH-347 certified payroll forms available here!

Please note that all deductions must be in accordance with the provisions of the Copeland Act Regulations, 29 C.F.R., Part 3. If the employee worked on other jobs in addition to this project, you'll show the actual deductions from his/her weekly gross wage, and indicate that those deductions are based on his gross wages.

Net Wages Paid For Week

Enter the net wages paid to the employee for this pay period.

The total net wages will auto-calculate and autofill for you when using our Excel and PDF WH-347 certified payroll forms available here!

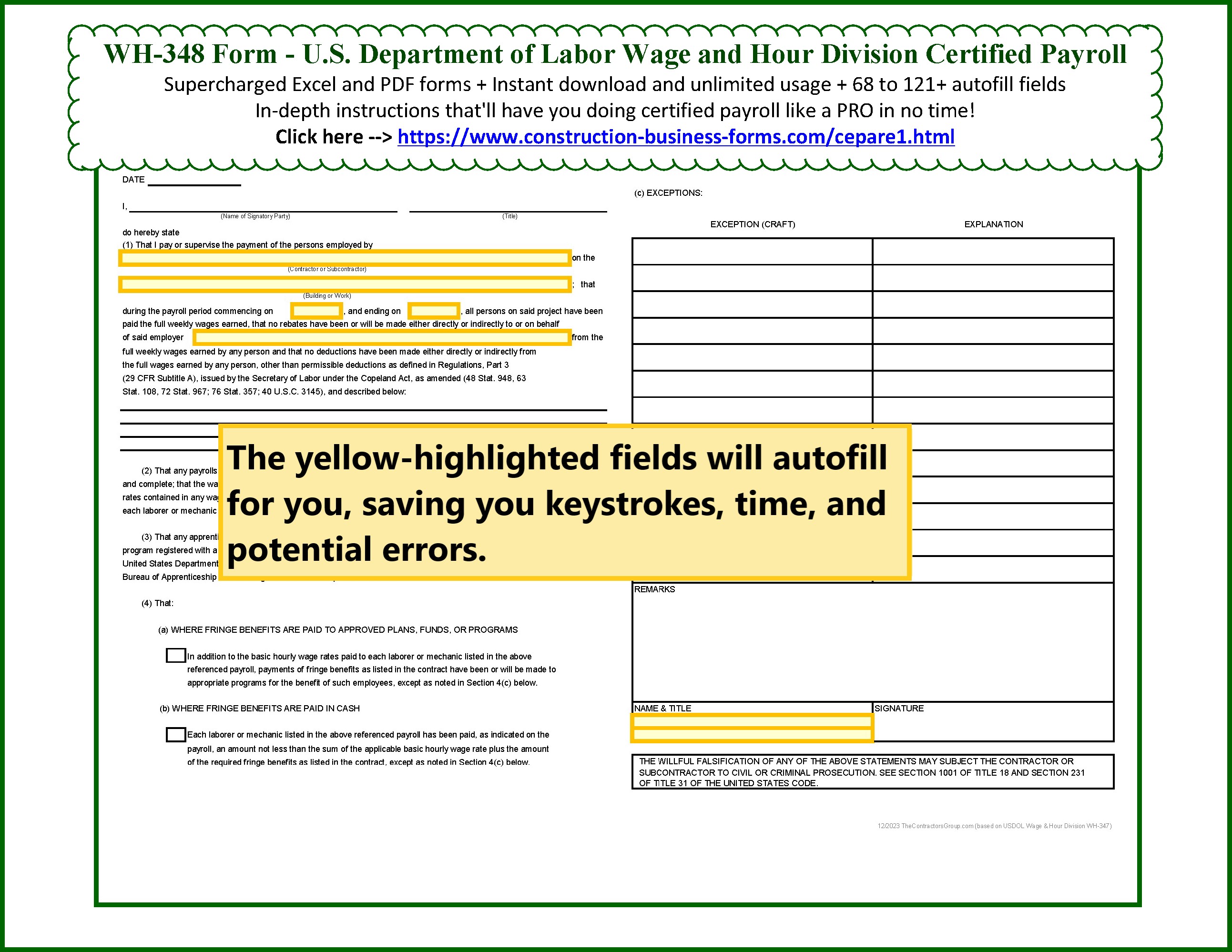

The WH-348 Statement of Compliance Forms

How to Fill in the WH-348 Statement of Compliance forms

The WH-348 Statement of Compliance (as well as the WH-347) can be filled in by anyone but the person who signs it must have current knowledge of the payroll for the company. This is because the signer is stating, under risk of penalty, that the information being submitted in the WH-347 & WH-348 forms is accurate.

It also provides for the contractor to report how he/she paid fringe benefits, whether directly to the employee or to a qualified plan or program, which is another reporting requirement.

Okay, let's keep going, we're almost done!

Date

Typically you'd enter the date you're filling in the form.

Signatory Party

The signatory party is the person who who will be signing the payroll form.

As mentioned above, the WH-348 Statement of Compliance (as well as the WH-347) can be filled in by anyone but the person who signs it must have current knowledge of the payroll for the company. This is because the signer is stating, under risk of penalty, that the information being submitted in the WH-347 & WH-348 forms is accurate.

It also provides for the contractor to report how he/she paid fringe benefits, whether directly to the employee or to a qualified plan or program, which is another reporting requirement.

Title of Signatory Party

Enter the title of the person who will be signing the form.

Item (1): Contractor or Sub-Contractor

This will be the same as what you entered in the "Name of Contractor or Subcontractor" field on the WH-347.

This field will autofill for you when using our Excel and PDF WH-347 certified payroll forms available here!

Building or Work

This will be the same as what appears in the "Project and Location" field on the WH-347 form.

This field will autofill for you when using our Excel and PDF WH-347 certified payroll forms available here!

Payroll Period Commencing On and Ending On Dates

Enter the first date of the payroll week in the first field and the last date of the payroll week in the second field.

These fields will autofill for you when using our Excel and PDF WH-347 certified payroll forms available here!

... "Of Said Employer"

This will be the same as what you entered in the "Name of Contractor or Subcontractor" field on the WH-347.

This field will autofill for you when using our Excel and PDF WH-347 certified payroll forms available here!

Describing Deductions Made

Four lines have been provided between the sections or items (1) and (2) for describing any deductions made. If you were able to provide adequate descriptions of all deductions in the "Deductions" column on the WH-347, you can enter here "See Deductions column in this payroll."

Items (2) and (3)

These are statements of fact that the signer is agreeing to, stating that these rules have been adhered to.

Item (4): Fringe Benefits

These instructions are straight from the USDOL Wage & Hour Division

Contractors who pay all required fringe benefits: If paying all fringe benefits to approved plans, funds, or programs in amounts not less than were determined in the applicable wage decision of the Secretary of Labor, show the basic cash hourly rate and overtime rate paid to each worker on the face of the payroll and check paragraph 4(a) of the statement on page 2 of the WH-347 payroll form to indicate the payment. Note any exceptions in section 4(c).

Contractors who pay no fringe benefits: If not paying all fringe benefits to approved plans, funds, or programs in amounts of at least those that were determined in the applicable wage decision of the Secretary of Labor, pay any remaining fringe benefit amount to each laborer and mechanic and insert in the "straight time" of the "Rate of Pay" column of the payroll an amount not less than the predetermined rate for each classification plus the amount of fringe benefits determined for each classification in the application wage decision. Inasmuch as it is not necessary to pay time and a half on cash paid in lieu of fringe benefits, the overtime rate shall be not less than the sum of the basic predetermined rate, plus the half time premium on basic or regular rate, plus the required cash in lieu of fringe benefits at the straight time rate. In addition, check paragraph 4(b) of the statement on page 2 the payroll form to indicate the payment of fringe benefits in cash directly to the workers. Note any exceptions in section 4(c).

Item (4): Exceptions

These instructions are straight from the USDOL Wage & Hour Division

Any contractor who is making payment to approved plans, funds, or programs in amounts less than the wage determination requires is obliged to pay the deficiency directly to the covered worker as cash in lieu of fringe benefits.

Enter any exceptions to section 4(a) or 4(b) in section 4(c). Enter in the Exception column the craft, and enter in the Explanation column the hourly amount paid each worker as cash in lieu of fringe benefits and the hourly amount paid to plans, funds, or programs as fringe benefits.

The contractor must pay an amount not less than the predetermined rate plus cash in lieu of fringe benefits as shown in section 4(c) to each such individual for all hours worked (unless otherwise provided by applicable wage determination) on the Federal or Federally assisted project.

Enter the rate paid and amount of cash paid in lieu of fringe benefits per hour in column 6 on the payroll. See paragraph on "Contractors who pay no fringe benefits" for computation of overtime rate.

Remarks

Here you'll enter any additional remarks in relation to any exceptions listed above.

Name and Title

Enter the name and title of the signatory party, which would be the same that you entered at the top of the WH-348.

These fields will autofill for you when using our Excel and PDF WH-347 certified payroll forms available here!

Signature

This is where the signatory party signs.

* Signatory party = the person signing the form.

Don't Let These Certified Payroll Forms Cause You Any Worry!

Of all the forms that contractors are required to submit, these ones cause some of the greatest anxiety.

When I first had to fill out these forms I was lost. I had no idea what I was doing which is scary. It made prevailing wage projects a pain in the rear!

So I *totally* understand if you are concerned about how to use this form.

But I found that they're actually very easy to do once you know what goes where.

And when using these forms you'll be able to save master copies for every project so that you won't be filling in redundant information every time you have to submit a new form.

I've included instructions in the download package about how to do that.

If you're at all nervous about these forms *please* don't be. I have no doubt that you'll have it down quicker than I did myself! :o)

And please do not hesitate to contact me should you have any questions or concerns. I'm here to help. :o)

Get your fill-able, calculating WH-347 & WH-348 Certified Payroll Forms

in Excel and/or PDF version here.

Back to the top of this page: How to fill in WH-347 & WH-348 Certified Payroll Forms

Back to the home page: InformedContractors.com

New! Comments

Please leave me your comments below. Facebook doesn't notify me of comments but I'm tickled when I come across them and I always respond when I see them.